There comes a time when money troubles affect all of us, but unfortunately it can all too quickly spiral out of control if you’re not careful. If you have more than one credit card or several different loan agreements in place then keeping track of everything can fast become a nightmare, leaving people wondering how exactly they should be handling their finances in the correct way.

There comes a time when money troubles affect all of us, but unfortunately it can all too quickly spiral out of control if you’re not careful. If you have more than one credit card or several different loan agreements in place then keeping track of everything can fast become a nightmare, leaving people wondering how exactly they should be handling their finances in the correct way.

Debt consolidation is one solution that can often help those who have their borrowing all over the place, and when it comes to this method you’ll find that Scotland is a country that takes a lot of stress out of money matters.

That’s because Scotland allows its citizens to take out something called a Scottish Trust Deed when they’re struggling with multiple repayment arrangements. This is a legally binding arrangement between an individual and their creditors, where unaffordable payments are transferred into a single affordable monthly payment. This legal agreement can only be carried out through a licensed Insolvency Practitioner, who then acts as the trustee for your arrangement.

The big advantage to using a Scottish Trust Deed is that you’ll be protected from your creditors. They won’t be able to take legal action against you for not making repayments, and you can also enjoy peace of mind that your home and car are protected against being repossessed.

The repayments are also based on your circumstances, so you will only have to pay what you can reasonably afford. The pressure of unwanted phone calls with creditors is also removed as a trustee will take care of everything for you.

Should you invest while still in debt? When should you start investing? You may want to start investing despite still being in debt.

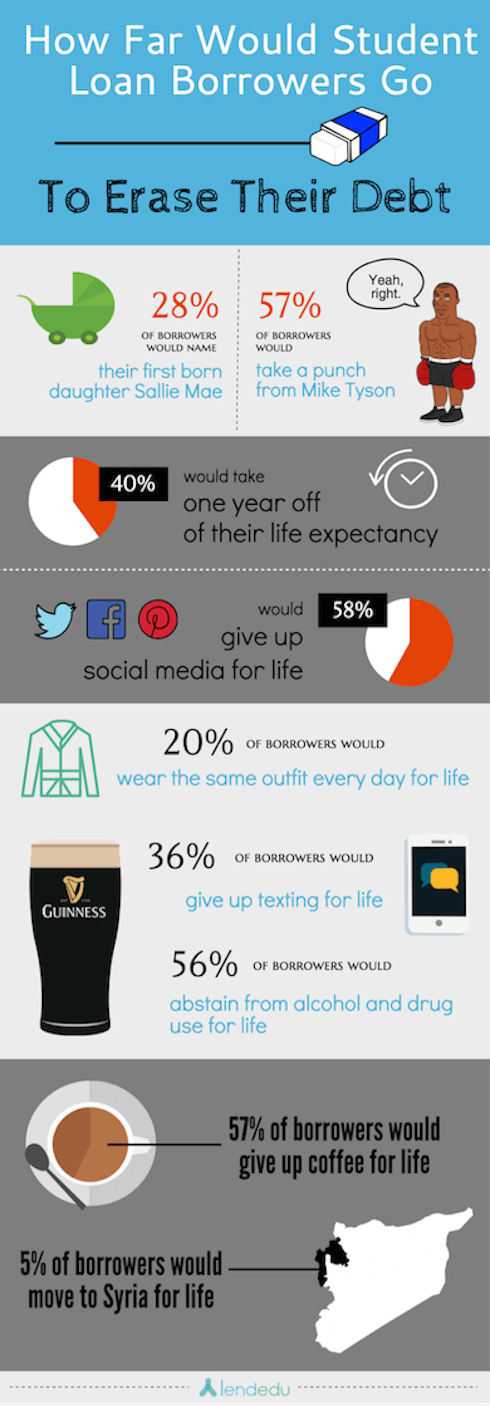

Should you invest while still in debt? When should you start investing? You may want to start investing despite still being in debt. Student loan debt is something of an elephant in the room for couples nowadays, because it’s not fun or easy admitting just how big the burden is and discussing finances sometimes causes anxiety for both people involved. If you have a small student loan to pay back or you’ve paid off your schooling altogether, it can be tricky navigating issues like marriage when your partner has a significantly higher

Student loan debt is something of an elephant in the room for couples nowadays, because it’s not fun or easy admitting just how big the burden is and discussing finances sometimes causes anxiety for both people involved. If you have a small student loan to pay back or you’ve paid off your schooling altogether, it can be tricky navigating issues like marriage when your partner has a significantly higher