Lauren Greutman is everywoman. And her tale of coming back from a life of debt is inspiring. In her new book, The Recovering Spender, Lauren Greutman lays out her mistakes (like many of us), how she overcame them, and then how you can too.

Lauren Greutman is everywoman. And her tale of coming back from a life of debt is inspiring. In her new book, The Recovering Spender, Lauren Greutman lays out her mistakes (like many of us), how she overcame them, and then how you can too.

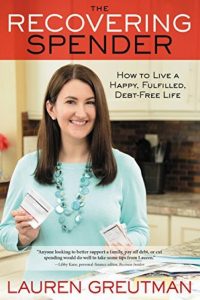

The Recovering Spender by Lauren Greutman is half memoir and half “how to” book on taking back control over your finances and control over your spending.

I’ve often been critical of my fellow personal finance bloggers. Most of them fall into two camps. They typically are: #1 – fall along as I chronicle my life getting out of the massive credit card and student loan debt that I’ve created. #2 – financial experts with the degrees and background to back up the actionable advice and tips they provide.

I personally like, and fall into, the second category. I often do think that readers would care about my personal life. But, often, I’m in the minority of the personal finance blogging scene.

Lauren’s story is a classic personal finance blogger’s tale of too much credit card debt and overspending. Bloggers love to share their stories of coming back, and Lauren’s book is no different. If you love reading personal finance blogs, you’ll love Lauren’s new book.

A lot of readers love to follow along with the underdog and witness the comeback story first hand. And, most personal finance blogs provide that coverage for readers.

That’s what’s made Lauren’s blog, IAmThatLady.com (later rebranded into LaurenGreutman.com) so popular. If you haven’t checked out her awesome blog that started it all, you definitely should.

I have to admit…I was sucked into her story about working her way up the chain at a Multi-Level Marketing (MLM) company and using her credit cards to get ahead. Like most readers, I’m fascinated by the story. And, the book didn’t disappoint…it has a great opening story of Lauren’s fall and then ultimate comeback.

The Recovering Spender by Lauren Greutman

Lauren Greutman has been where many of you find yourself today. She’s been in debt and struggling. And, she’s clawed her way back. Her book, The Recovering Spender, shares her story, and it also provides readers with simple and successful strategies to overcome your debt.

The Recovering Spender Offers Hope

The Recovering Spender by Lauren Greutman is a book that offers hope. It’s a book for the American spender, those who don’t necessarily have Roth IRAs and stock portfolios. But, it’s for those guys too (believe it or not).

The Recovering Spender is a book for people who hate talking about money, who hate to budget. It talks about getting out of debt in plain English, which is something that should resonate with the readers of Money Q&A too.

It’s a book for people who have struggled with debt, continue to struggle, and want to get out of debt.

Financial stability is a terrifying phrase because it’s something we all aspire to, even if we don’t quite understand how to get there. The phrase calls to mind thoughts of sacrifice, eating ramen, and living paycheck to paycheck while you save every spare penny, but it’s neither that complicated nor that scary.

Financial stability is a terrifying phrase because it’s something we all aspire to, even if we don’t quite understand how to get there. The phrase calls to mind thoughts of sacrifice, eating ramen, and living paycheck to paycheck while you save every spare penny, but it’s neither that complicated nor that scary. Should you invest while still in debt? When should you start investing? You may want to start investing despite still being in debt.

Should you invest while still in debt? When should you start investing? You may want to start investing despite still being in debt.